Investing money isn't as complicated as it seems, but it does require some consideration, planning, and strategy. There are four steps that are the foundation of any good investment strategy.

Risk Tolerance

Understanding your tolerance for volatility in the value of your investments is critical. Ask yourself, can I handle a 10% decline in the value of my investments? How about 20%? 40%?

Something that I’ve learned is that tolerance for risk tends to go up when people understand why things go up and down. So, I’d suggest that you don’t pay too close of attention to the day to day movements in price. Instead, spend your time learning more about why things go up and down.

Time Horizon

Knowing how long you plan to invest for is essential as well. Once you have identified your time horizon, you can determine the appropriate type of investment vehicle. For example, equity cycles take at least 7 – 10 years, and therefore should be avoided as a short term investment. Investing in equities for a short term horizon runs the risk of needing the money when the value is depressed, which of course is contrary to the goal. Conversely, fixed income investments such as GICs, bonds, and Real Estate Investment Trusts tend to pay out a steady stream of income, though don’t tend to produce wild swings in their value like stocks will. Because of that, they are more suitable for shorter time horizons.

A very good way to approach the time horizon issue is to spend some time thinking and prioritizing your financial goals. For example, if you’re wanting to replace your car in 5 years, go on a vacation in 2 years, and retire in 20 years, you should consider having different “pools” of investment money for each of these goals.

Asset Allocation

Asset allocation refers to the way different classes of assets relate to each other in your investment portfolio. It is your asset

allocation that will determine what type of return you are able to achieve over the long term. There are essentially 2 primary asset classes that the novice investor should consider using: equity (stocks) and fixed income (or bonds, etc). I refer to these classes as ownership (equity) and loanership (fixed income)

Equity (stocks) – when investing in equity, you become a part owner of a company. As such, you have an opportunity to participate in the profits and growth of that company over time.

Fixed Income (bonds, GICs, etc.) – when you invest in fixed income products, you are essentially investing in debt. Mortgage funds and real estate investment trusts are other examples of fixed income products. These are methods of pooling money together for the purpose of lending it out. The return on these products is usually in the form of an income stream.

As mentioned previously, the relative ratio of these two asset classes in your portfolio will determine the overall volatility and return of the portfolio. So, investors with a short time horizon or a low tolerance for risk should have more fixed income products, and investors with long time horizons and a higher tolerance for risk should have more equity products.

Rebalancing

Rebalancing refers to maintaining a particular balance of individual investments in your portfolio. Because different investments will move in different ways at different times, the particular weighting that you might like each to have in your portfolio might change over time as some go up and some go down.

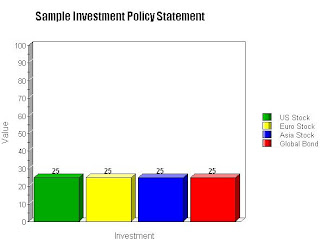

So, let’s imagine that you’ve decided that your portfolio should have 25% weightings each in US Stock, European Stock, Asian Stock, and Global Bonds:

Now, let’s imagine that one year later, their relative performance looks like this:

As you can see, in order for us to take this back to the original balance at 25% each, we will have to sell the Asia and US stock to buy more of the Euro stock and Global bond. This forces us to maintain our discipline in sticking to our original investment policy of 25% weightings, as well as forces us to sell high and buy low. Equity and Fixed Income tend to perform in cycles. By maintaining your discipline in rebalancing, you take advantage of that cyclical pattern.

In conclusion, if we are to follow these 4 steps rigorously, it takes the guesswork and uncertainty out of our investment strategy, and gives us a fixed benchmark to work from.

No comments:

Post a Comment